GKP, XEL, RRL .. City Index and Accendo Markets

March 24, 2012 § Leave a comment

So I have signed up to Accendo Markets to see if their platform is any better than the new City Index platform. Results are a little inconclusive and I am still trying to work out how to trade in the way that I am used to. A good feature on Accendo is the way you can trade directly off the chart so keeping the windows on my laptop to a minimum. The spreads and finance options are cheaper and smaller than the City Index ones so that is also a bonus. I got really pissed off having to wait for a phone call only trading situation as I prefer to work with the charts and not a broker and City Index invariably go to Phone Only when the liquidity dries up or things start moving rapidly.

Accendo tell me that I am buying a CFD directly off them, hence everything is cheaper and quicker! We’ll see.

Their charting package is quite basic and has about 80% of the things I would like , however for a subscription you get Prorealtime charting and live feeds. You get DMA, Level 1 and for a small subscription you get Level 2. All of which becomes free if you make more than 1 trade a month. Again, we’ll have to wait and see what hidden charges there are if any. There are also a lot more features supplied by IG , including their Chart Pattern recognition software.

The Accendo tele sales person didn’t really sell the platform to me, just showed me around. The conversations were based on me trying their software rather than placing money with them so that is a bonus to them. I hate feeling like the pressure is on to fund your account.

My RRL is looking very dangerously close to the Stop order that I placed at break even. If the shares get sold I’ll move the money out of iii.co.uk and into Accendo and see if I can trade the CFDs instead.

GKP is back in a range. The big red mother candle is keeping a lid on any upward movements.

Gaps are getting filled so that is good to know, should there be any fades after gap ups I may just join in until we pop out of the higher levels.

I’ve posted a gkp chart from both the City Index and Accendo Markets charting software to show the difference in style and price.

XEL is filling in below a small trend line and approaching the bigger trend line. Maybe if it gets down to there I’ll trade up a £1000 of CFD’s. Can’t get much lower surely!

Gulfkeystone Petroleum (GKP)

March 17, 2012 § Leave a comment

I am no longer in this share but I am keeping an eye on it again.

If I get some funds this is how I’ll trade it. I am overall bullish as we are in a long term uptrend so I would be looking for breaks above the lines on the chart.

Though getting funds to actually trade this is impossible for me at the moment. So I’ll probably sit on the side lines and think of what could have been. Booh ;(

Luckily I have RRL to keep me happy.

Range, Xcite and Gulf Keystone

March 10, 2012 § Leave a comment

GKP, XEL & RRL

All look pretty bullish to me, and if I were to be looking for more buying opportunities I reckon now would be as good as any.

Maybe I am slightly biased with RRL and XEL but now that GKP has retraced and held I can see the support but not really a real resistance.

Any share that retraces 61.8% of a move and then holds is a good buy for me.

Though a 50% retrace is almost as good 😉

So fingers crossed the XEL rig and the RRL wells continue in a positive way and good luck to all that hold GKP I feel the worst is over now.

End of February Review

February 24, 2012 § Leave a comment

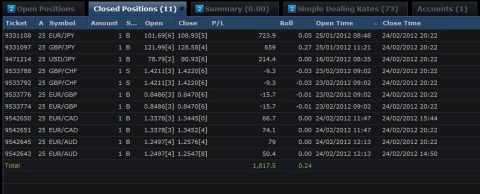

So I closed all my real trades today as I am unable to watch over them this next few days. Plus I am in profit and didn’t want to watch them slide back to break even.

This month I also got stoppped out of GKP which I feel good about for the time being, I am sure that if it rockets to £20 next week I’ll be kicking myself but I got out without emotions and the stop was high enough to lock in 100% profits.

This is the first month in what seems like ages that I have been able to concentrate on taking profits, though the first half of the month i was down 3.5% on the forex. I was almost resigned to the fact that I would be posting another negative month. However, I traded smaller amounts and followed the strategy to the letter. The results were better than expected and today I closed out 1800+ pips.

The strategies that I am trading on the live account are trend following and I closed out mid trend I am sure on a few of the trades but I am happy that if I follow the rules in March I’ll be posting another positive result here.

The images show my biggest profitable trade in Feb, the EUR/JPY and the account balance on todays live account at the close and the demo account with its on going trades.

GKP, XEL and RRL

February 22, 2012 § 2 Comments

So my RRL are at break even, pat on the back, lets hope it lasts.

XEL, though there was some good news, the share price has not gone north, so no action taken by me. I have indicated on the chart where I start doing something. Though it could take a while.

GKP, got stopped out today and I feel pretty good about it. I was never going to be a millionaire with this share like some, though I have made my first 100% profit on a share and it is banked. I had said that I was looking to get out of the AIM and this is my first step to doing so. Though it will take about 4 days for the funds to clear in my iii account and then a few more to get out of that account into another , so I am guessing that I wont be able to top up the FX account until mid March.